Online fraud has become smarter—and sneakier. If you’ve worked in fraud prevention, you know how quickly bad actors adapt. From fake signups to card testing and account takeovers, threats keep evolving. So how do you keep up? One answer is IP Intelligence for Online Fraud Prevention. Think of it like a digital gut-check. With just an IP address, you can get a sense of who’s on the other side of the screen—where they’re located, how they’re connecting, and whether you should be worried.

Let’s break down how this works, where it fits in your fraud strategy, and why so many teams are making IP data a core part of their defenses.

What is IP Intelligence, Exactly?

Every user that visits your platform brings an IP address with them. IP Intelligence means using that address to uncover details that help you assess risk.

You can learn things like:

- Where the user is geographically

- If they’re using a VPN, proxy, or Tor

- Whether the IP is tied to a data center, mobile network, or home Wi-Fi

- Past history of that IP—spam, abuse, fraud, etc.

- Whether it’s been involved in suspicious or automated activity

This gives you context. You don’t just see a login attempt. You see that it’s coming from a cloud server in another country known for fraud.

Why Use IP Intelligence for Online Fraud Prevention?

If fraudsters always followed a pattern, your job would be easy. But they don’t. They switch devices, rotate IPs, mask locations—you name it. The good news? Many of these tricks still leave behind IP breadcrumbs.

That’s where IP Intelligence comes in. It helps you:

- Flag suspicious behavior before it escalates

- Catch location mismatches (e.g., someone claiming to be in the U.S. is really connecting from overseas)

- Detect automated traffic from bots or scrapers

- Filter out known malicious IPs quickly

- Protect your users and revenue by stopping fraud in its tracks

And it does all of that quietly, without interrupting the user experience.

How Businesses Use IP Intelligence in the Real World

1. E-Commerce Fraud Prevention

Online retailers deal with fake orders, card testing, promo abuse, and more. If multiple orders come from the same IP—or if the IP shows signs of automation—you can block or flag the activity.

Retailers often use IP Intelligence to:

- Identify and stop fake transactions

- Detect multiple accounts from the same subnet

- Block known bad IPs from even reaching checkout

2. Fintech and Banking

Money attracts fraud. Financial platforms use IP data to verify users, monitor logins, and prevent account takeovers.

Some use cases include:

- Flagging logins from high-risk countries

- Detecting unusual IP patterns

- Blocking attempts that involve anonymizing tools like VPNs or Tor

3. SaaS Platforms

If you’re running a SaaS business, you probably offer free trials or tiered plans. Fraudsters love exploiting these.

With IP Intelligence, you can:

- Catch fake signups coming from disposable emails and IP ranges

- Stop multiple trial abuses from the same IP block

- Identify scraping attempts from cloud-based bots

How IP Intelligence for Online Fraud Prevention Works

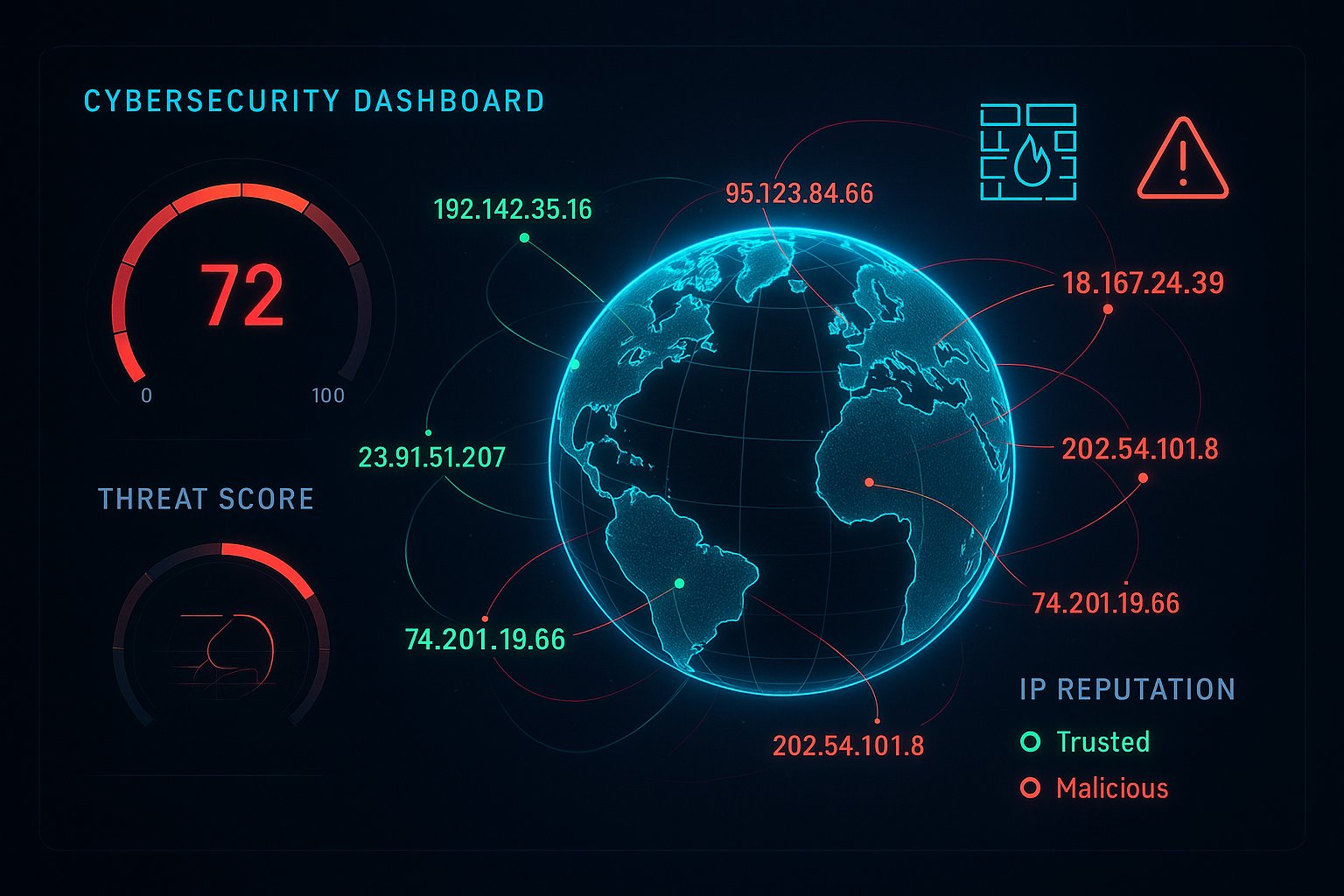

Reputation-Based Insights

IP addresses can have a history. If an IP has been used in past fraud attempts or appears in threat feeds, that’s valuable information. Reputation databases track that history.

Real-Time Risk Scoring

Many tools give each IP a score—low risk, medium, or high. That score might factor in location, device type, anonymity, and behavior.

You can set thresholds. For example: “If the score is above 80, require additional verification.”

Integration via APIs

Modern tools make integration easy. With an API, you can run IP checks during:

- Login attempts

- New account creation

- Checkout or payment processing

The whole process usually takes milliseconds.

Machine Learning Backups

Advanced fraud tools use machine learning to spot new trends—like emerging proxy networks or newly abused IP ranges—without relying on hardcoded rules.

Why It’s Worth Using

Using IP Intelligence isn’t just about blocking bad guys—it helps you improve everything from conversion rates to compliance.

Here’s what you get:

- Faster decisions – Automate what used to take minutes or hours

- Fewer false alarms – Only flag what truly looks off

- Happier users – Legitimate traffic flows smoothly

- Lower costs – Less manual review, fewer chargebacks

- Better control – You set the rules that match your business

Best Practices for Getting the Most Out of It

Want to make IP Intelligence part of your stack? Here are a few quick tips:

- Don’t rely on IP data alone. Combine it with device fingerprints, behavioral data, and location history.

- Set custom risk thresholds. What’s risky for one business might be normal for another.

- Look at patterns. A single IP might not stand out—but 50 signups from one subnet in an hour? That’s a problem.

- Update your rules. Fraud tactics evolve. So should your response.

- Be smart with blocks. Blocking entire regions or IP ranges can prevent fraud—but may also affect real users. Use soft blocks or extra verification when needed.

Ready to explore?

Fraudo.io Offers IP and device-level fraud detection with flexible APIs

Final Thoughts

Fraud isn’t going away—but it can be managed. And smart teams know that small details like an IP address can reveal a lot.

IP Intelligence for Online Fraud Prevention gives you an edge. It turns every user connection into a piece of risk data you can act on. Whether you’re stopping fake logins, blocking bot traffic, or protecting your checkout, IP data helps you move faster—and smarter.

If you’re ready to cut down on fraud and keep your users safe, Fraudo.io is a great place to start.

Also Read:

Best Practices for Email Reputation Checks

Understanding IP Reputation and Risk Scoring

FAQ: Common Questions About IP Intelligence

1. Can someone fake an IP address?

Yes—using a VPN, proxy, or Tor. But good IP tools can usually detect that and flag it.

2. Is using IP data legal?

Yes, in most cases. IP addresses are usually considered non-personal under privacy laws like GDPR, as long as you use them responsibly.

3. How hard is it to set up?

Most services offer APIs that are easy to plug into login flows or checkout systems. It usually takes a day or two to go live.

4. What types of fraud can it detect?

Everything from fake account creation to carding attacks, scraping, location spoofing, and bot-based activity.